PDF) The Effect of Financial Leverage on Financial Performance: Evidence of Quoted Pharmaceutical Companies in Nigeria | Ali Zain - Academia.edu

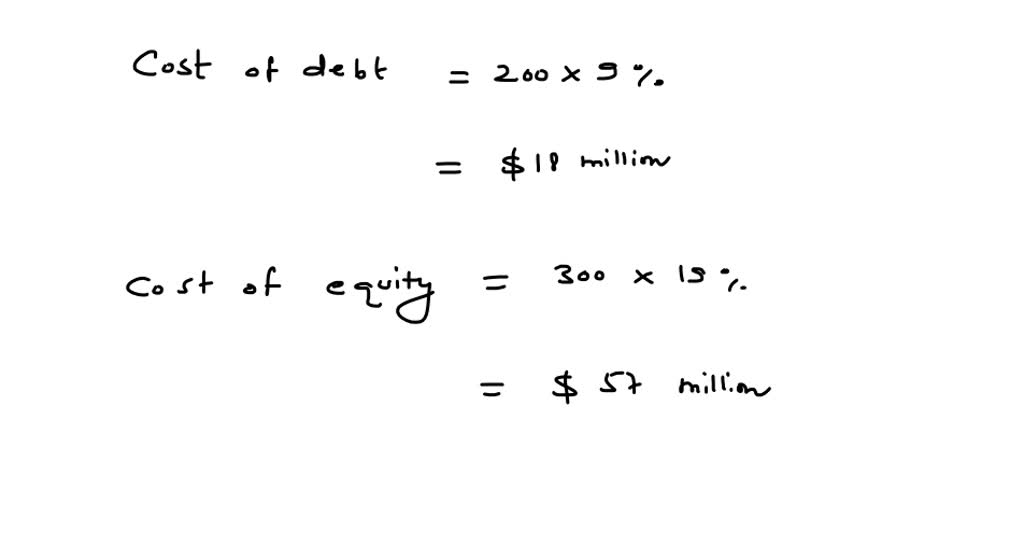

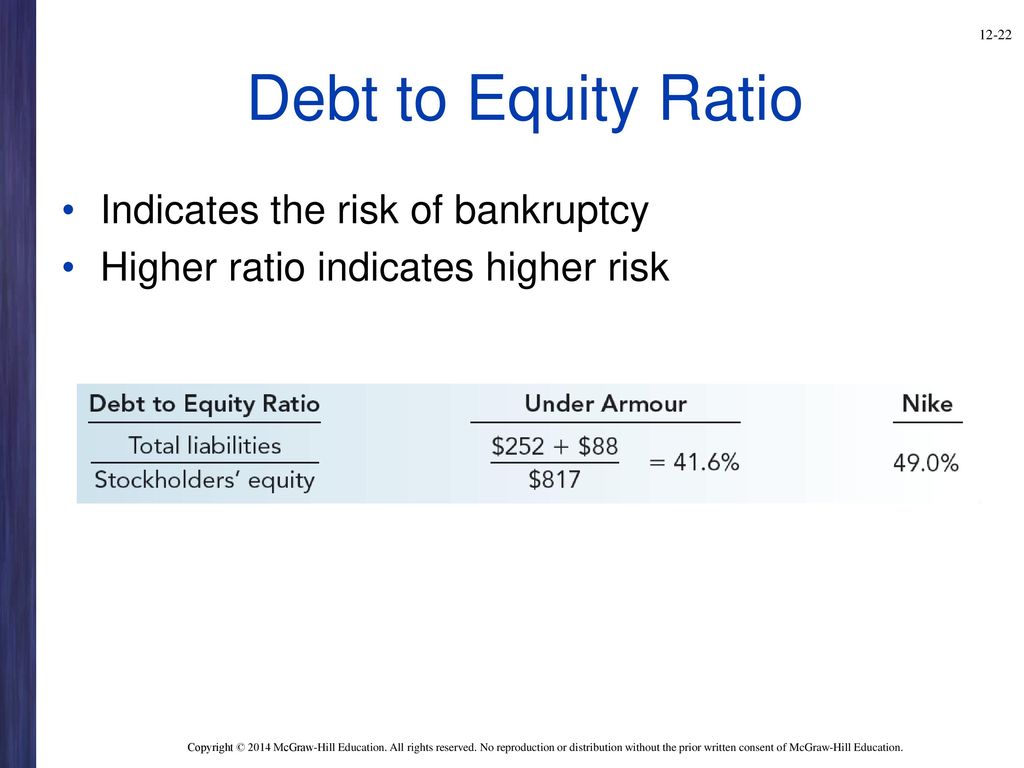

SOLVED: Nike, Inc., has a debt-equity ratio of 2.3. The firm's weighted average cost of capital is 10 percent and its pretax cost of debt is 6%. The tax rate is 24%.

:max_bytes(150000):strip_icc()/TermDefinitions_Debt-to-CapitalRatio-c25b169207f64c2d8759194ba8be3aa9.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1152522435-5e7fb93156e3488281174dbfd0bc70bc.jpg)